1 August 2014

Malaysia Airports has posted a +7.2% increase in non-aeronautical revenue to RM561.5 million (US$174.6 million) for the six months ended 30 June 2014.

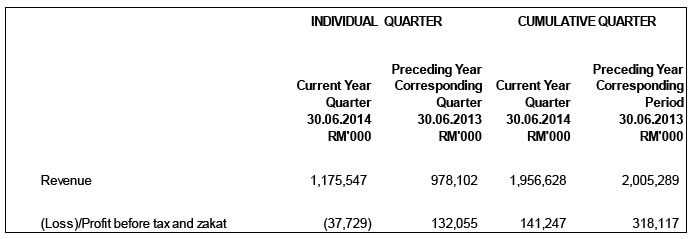

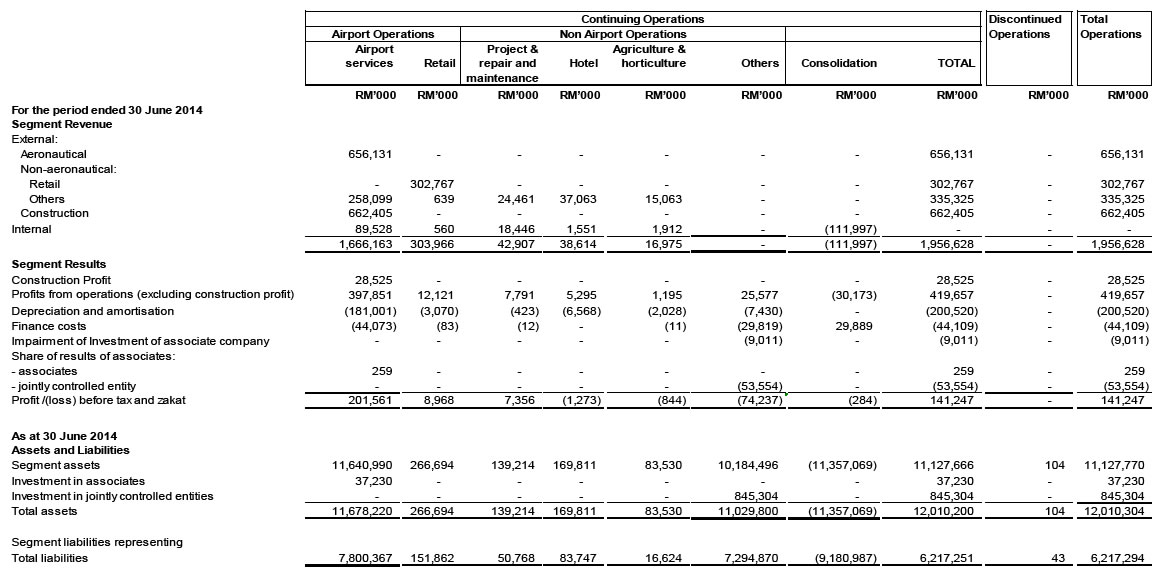

The airport company’s own retail business – consisting mainly of Eraman – grew by +7.0% to RM302.8 million (US$94.2 million) in the half-year period, driven by a rise in passenger volume and higher retail spending by passengers.

Revenue from rental of space and other commercial segments grew +9.9% to RM215.7 million (US$67.1 million), contributed mainly by higher rental royalty and increase in rental space at klia2.

Aeronautical revenue increased by +13.4% to RM656.1 million (US$204 million) over the six months, buoyed by higher passenger and aircraft movements as well as the implementation of new landing and parking charges.

Overall, consolidated revenue dipped by -2.4% to RM1,956.6 million (US$608.4 million), including construction revenue from klia2 amounting to RM662.4 million (US$206 million). EBITDA fell by -1.2% to RM448.2 million (US$139.4 million), while profit after tax also declined by -63.2% to RM84.0 million (US$26.1 million) in the first half.

Excluding this construction revenue, revenue from airport operations (comprising retail and airport services) increased by +10.5% to RM1,217.6 million (US$378.5 million) for the half-year period.

A total of 41.3 million passengers – an increase of +11.8% – passed through the company’s 39 airports in Malaysia in the first half. Strong air travel demand within the Asia Pacific region has resulted in growth of international and domestic passenger movements of +10.4% and +13.1% respectively.

Total passenger movements at KLIA increased by +9.7% to 24.4 million, with KLIA’s Main Terminal Building and klia2/LCCT recording growth of +9.2% and +10.1% respectively. All other airports recorded strong aggregate growth in total passenger movements of +14.9%.

While traffic growth continues to remain positive, the percentage of growth has declined slightly in May and June, partly due to a higher growth base in 2013. In addition, traffic between certain sectors such as Thailand, China and the Middle East have weakened due to political uncertainties in Thailand, the escalating conflict in the Middle East and the residual impact from the MH370 incidents. The tragic MH17 event on 17 July may also temporarily affect passenger numbers, Malaysia Airports noted.

On the airline front, Malaysia Airports expects Malaysia Airlines, AirAsia Group and Malindo Air to continue to contribute strongly to passenger growth together with other foreign airlines. Malaysia Airlines’ entry into the Oneworld Alliance in February 2013 has increased its market outreach and breadth of connectivity across continents, while the expected seat capacity expansion coupled with strong tourist arrivals for Visit Malaysia Year 2014 will continue to fuel the growth momentum.

Based on the current year to date traffic performance and the “foreseen uncertainties”, Malaysia Airports said it “remains confident” to register a robust passenger growth for the year as it continues to pursue airlines by enhancing its marketing efforts.

Original Source: www.moodiereport.com

Site Search

Did you find what you are looking for? Try out the enhanced Google Search: